Accessing Payroll Reports

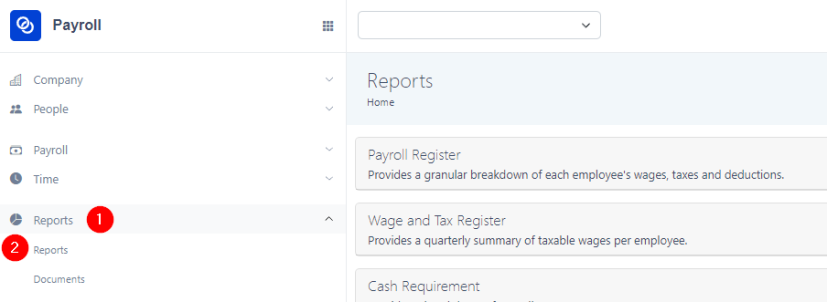

Reports can be accessed through several sections within CertiPay Online.

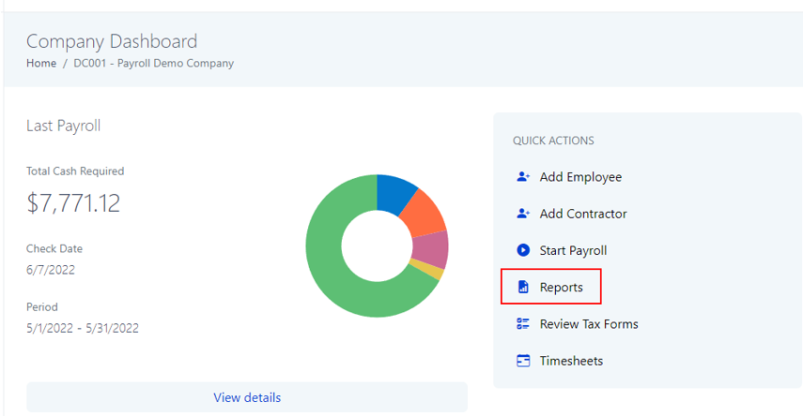

Dashboard Access

Via the Reports tab

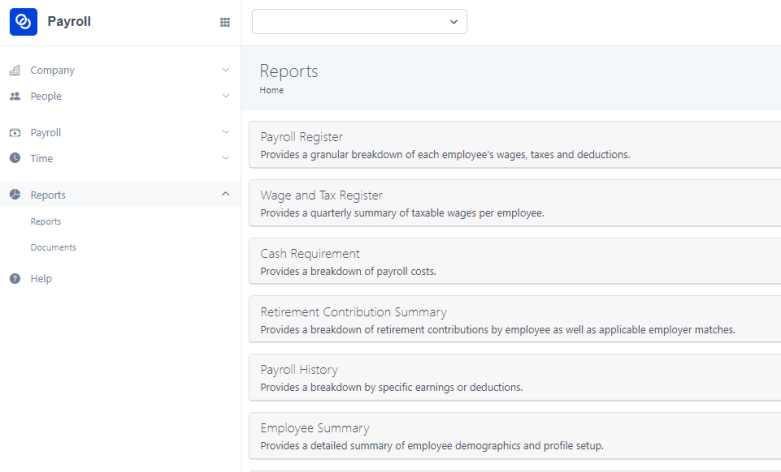

Once in the reports section, select the report you wish to view:

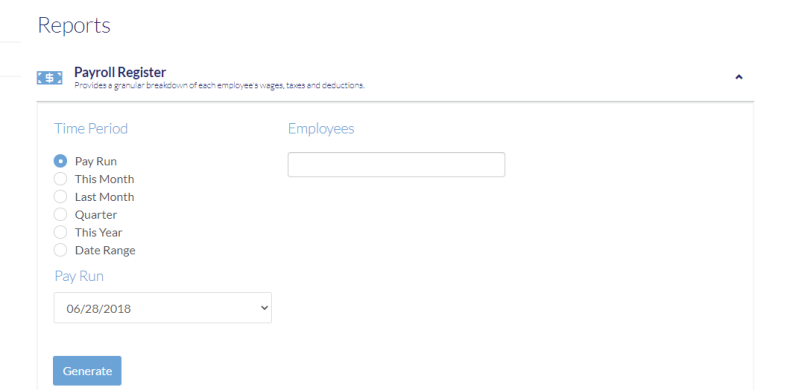

On this screen, you can select a range of reports you would like to generate. Each tab offers a variety of options to fine tune the report you are needing like time period, pay run, employees and work locations.

Time periods allows you to also go by pay run, current month, last month, quarter, year and date range.

Enter the options for the chosen report and click Generate:

Available Reports:

Payroll Register - Provides a granular breakdown of each employee's wages, taxes and deductions.

Wage and Tax Register - Provides a quarterly summary of taxable wages per employee.

Retirement Contribution Summary - Provides a breakdown of retirement contributions by employee as well as applicable employer matches.

Employee Summary - Provides a detailed summary of employee demographics and profile setup.

FICA Tip Credit - Provides a breakdown of creditable tips as well as total tips and is typically used alongside IRS Form 8027.

Active Employee Loan - Provides a list of all current active loans detailing YTD payments and outstanding balances.

Paycheck Protection Program - Provides a summary of annualized gross wages and average monthly payroll costs for the Payroll Protection Program.

Worker’s Compensation Report - If your company has elected to utilize PayGo services, this report provides a breakdown of subject wages as well as premiums due; otherwise, the report will provide subject wage details.